In September 2015, the United Nations adopted the new Sustainable

Development Goals (SDGs) for the year 2030, setting an ambition for a

safe and sustainable future for everyone, and especially for the less

privileged passengers aboard ‘Spaceship Earth’.

Here, we dive into Sustainable Development Goal 10: reduce inequality within and among countries. People living without adequate records are often locked into poverty and exclusion. As many as 2 billion people worldwide are without a bank account. They tend to use only physical currency, making them vulnerable to theft. Furthermore, they cannot borrow money via a formal loan, nor can they access most insurance.

Blockchain is a disruptive technology which can correct this systemic failure that excludes too many from the economy by enabling people to get a digital identity. Blockchain will be at the forefront of transforming the way in which value is transferred between individuals throughout the world. It will provide the opportunity to create products and services that generate sustainable and inclusive growth, to build a more equal world. The blockchain market is expected to grow at a compound annual growth rate of 61.5 percent, offering over $2 billion of new opportunities to be seized between today and 2021.

Venmo, WeChat, TransferWise.... Several emerging web-based peer-to-peer money transfer applications promise to deliver the same basic service: a fast, free, simple way to transfer money to another person. However, all of these apps have significant limitations (transfers only within a particular geographic region, personal financial information over the internet, vulnerability to hackers, etc.).

Blockchain technology can easily remedy the weaknesses of web-based social-finance apps, as the distributed apps that run on a blockchain (“Dapps”) provide immutability, security, privacy, and efficiency. Additionally, as the blockchain effectively exists anywhere in the world, it has no geographical limitations.

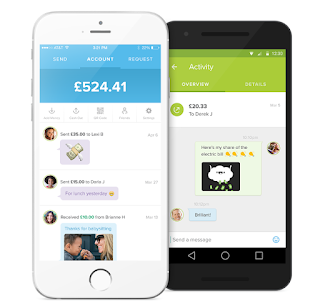

Circle Pay is a blockchain-based payment application from Circle with a simple proposition: “[S]end money anywhere, in any currency, without the friction (transfer delays and fees) of traditional clearance options”. Most importantly, Circle Pay transactions are not limited to virtual currency: Circle still runs on the bitcoin blockchain as its rail, but now Circle Pay users can deposit money to Circle from a Visa or MasterCard credit or debit card, and never have to deal with bitcoin at all. (Circle’s website doesn’t even mention the digital currency).

I personally love Circle. I find Circle Pay is the cleanest simplest implementation one could get from Blockchain's disruptive technology opportunity. I fully recommend reading this post signed by Circle's CEO Jeremy Allaire to get a full understanding about what Circle brings into scene.

As Jeremy states, Circle allows users "to share payments with and send money to friends, whether across the table or across the planet, with the speed, convenience, zero cost, and fun of the Internet". Long story short, an enriched Whatsapp-like app which, besides allowing users to chat, smile, share communications with their friends and groups circles, gives them the ability to send to or receive money from each other in a way which is as simple as adding emojis to text messages.

Now, let's stop for a moment and think about what disruption Circle Pay could provoke when placed in the hands of those 2 billion people we started this post with. A tool allowing them not only to communicate but also to pay and get payed, to confirm their social inclusion. As the convinced supporter I am for the UN' reduce inequality goal, I can only wish Circle the biggest possible success and I truly look forward to getting as many vulnerable people as possible to join the Circle in the forthcoming months.

Not surprisingly, Circle is being backed by $140 million in venture capital from investors including Goldman Sachs, IDG Capital Partners and Breyer Capital. As a result of such support, the company is currently undertaking an important users acquisition strategy which includes an ambitious ambassadors program aimed at creating brand awareness and generating consumers' traction worldwide.

But Circle's strategy is not without risks. An obvious one is the high entry cost associated to its competition landscape, and I am not talking here about sending and receiving money: in a world massively dominated by social communication tools such as Facebook Messenger or WhatsApp, it is tough to get additional space for new players, even when newcomers provide key features on top. Circle Pay allows me to do everything I do with WhatsApp today plus handling all money interactions with my contacts, such as sharing birthday gift payments in our family group or paying our baby-sitter. Provided they follow me and join Circle too. The question is: will such a difference be enough as to generate an active critical mass switch from WhatsApp-like apps? Will I become an spontaneous ambassador within my own circle of friends to make them realize that, if we switched all to Circle Pay, our next soccer team meal would be much easier to organize?

Users in highly developed countries, we are becoming lazier and lazier when it comes to mobile apps. Too much information, lots of things to handle, little time. We only act on must-have's, and Circle Pay current value proposition has the risk to be perceived / filtered as a nice-to-have only. That would be extremely unfair, and I believe most of those 2 billion vulnerable people would agree with me. They would do anything to get such an app installed and gain access to a must-have a social inclusion tool. Unfortunately, our western KPIs rarely take such realities into account, we lost the ability to measure success in the absence of demonstrable numbers. Circle will require to focus on users' acquisition penetration in highly developed countries, which is where the smartphones and the network infrastructures are massively run today.

So what could Circle do to handle such risk? How could they make sure their value proposition is perceived as a must-have in the First World, where social inclusion is -wrongly- not perceived as a major concern?

The answer is not in The Circle, it is in The Square.

Whether it is about sending or it is about receiving money, most of our money exchange interactions happen with people outside of our Circle. Our money exchanges happen with restaurants, pop-up stores, boutiques, flowers, chocolates, pubs, concerts, museums, visits, excursions, pubs, repair services, healthcare services, education services, books, sports, clubs, associations. We could represent such exchanges as happening inside a Square of business of all sizes and natures.

The premise is simple: "sending and receiving money does not primarily happen inside The Circle, money flows from and to The Square, therefore it is key for me to embrace The Square".

Introducing The Square inside the equation brings Circle's added value closer to a must-have. Think about Circle Pay no longer as a tool ""to share payments with and send money to friends" but as a tool ""to share payments with and send money to anyone, whether in my in-circle or my out-square", regardless of personal relationships. With the inclusion of The Square, the final solution would exponentially increase its potential.

Fair enough, nice theory but... how to get that into work? I mean, how to connect with people in The Square when I do not know who they are nor where they are nor what they can propose to me? After all, a Circle vision is static: my contacts are my contacts, no matter where I am, no matter where I go, no matter what I do. But The Square is intrinsically dynamic, it clearly depends on where I am, where I go and what I envision to do. How to Bluetooth for The Square?

This is when a Square technology needs to come into scene: geo-intelligence. Geo-intelligence not as "a static location pin in a map", like GoogleMaps. Geo-intelligence as "a dynamic content, offer, contract, opportunity or service with the ability to generate a money exchange transaction in a map", like Kitewalk.

Kitewalk is a Web-Services enabled technology company that can help answer the previous questions and deliver a Square implementation: from restaurants to sports clubs, from city town halls to concert organizers, Kitewalk can bring potential actors inside The Square of business the ability and the opportunity to get automatically discovered by users around them which would be interested in their products and/or services. Such discovery would happen at the appropriate times when a money exchange interaction would be likely to happen between them.

The reverse is also true: Kitewalk could also allow Circle Pay app users to keep handy not only their list of (static) Circle contacts but also the list of (dynamic) Square actors at reach who would likely provide to them the products or services they are looking for matching their time, space and user preferences criteria. Anytime. Anywhere.

At Kitewalk, we believe that introducing the notion of The Square as an extension to The Circle would boost the western users reasons to download Circle Pay. A tool which would not only allow to communicate and exchange money with your friends, but to communicate and exchange money with anyone.

After all, money is not about The Circle, it is about The Square.

One living example of Kitewalk's Web Services geographical intelligence layer and its fitness to deliver a Square implementation is MyHappyHour, Kitewalk's B2C testing platform. Created back in 2013, it features a B2C app which gets populated with Facebook Open Events which are nightly extracted via Facebook's Open Graph API for specific cities in the world (those where we have MyHappyHour end users using and consuming the published data). The app features a one-click event discovery button which works in time and space by correlating users with their times, locations and preferences to deliver to every user a unique vision of the world, anytime anywhere.

MyHappyHour does not allow for money exchange between parties because that is not part of Kitewalk's value proposition which is making relevant information reach the right user at the right time and in the right place. In exchange, just as Circle Pay, it does allows users to get in contact and chat both with their friends (The static Circle) and with the events organizers (The dynamic Square), wherever and whenever they are.

Blockchain disrupts. Geo-intelligence fuels such disruption.

Here, we dive into Sustainable Development Goal 10: reduce inequality within and among countries. People living without adequate records are often locked into poverty and exclusion. As many as 2 billion people worldwide are without a bank account. They tend to use only physical currency, making them vulnerable to theft. Furthermore, they cannot borrow money via a formal loan, nor can they access most insurance.

Blockchain is a disruptive technology which can correct this systemic failure that excludes too many from the economy by enabling people to get a digital identity. Blockchain will be at the forefront of transforming the way in which value is transferred between individuals throughout the world. It will provide the opportunity to create products and services that generate sustainable and inclusive growth, to build a more equal world. The blockchain market is expected to grow at a compound annual growth rate of 61.5 percent, offering over $2 billion of new opportunities to be seized between today and 2021.

Venmo, WeChat, TransferWise.... Several emerging web-based peer-to-peer money transfer applications promise to deliver the same basic service: a fast, free, simple way to transfer money to another person. However, all of these apps have significant limitations (transfers only within a particular geographic region, personal financial information over the internet, vulnerability to hackers, etc.).

Blockchain technology can easily remedy the weaknesses of web-based social-finance apps, as the distributed apps that run on a blockchain (“Dapps”) provide immutability, security, privacy, and efficiency. Additionally, as the blockchain effectively exists anywhere in the world, it has no geographical limitations.

Circle Pay is a blockchain-based payment application from Circle with a simple proposition: “[S]end money anywhere, in any currency, without the friction (transfer delays and fees) of traditional clearance options”. Most importantly, Circle Pay transactions are not limited to virtual currency: Circle still runs on the bitcoin blockchain as its rail, but now Circle Pay users can deposit money to Circle from a Visa or MasterCard credit or debit card, and never have to deal with bitcoin at all. (Circle’s website doesn’t even mention the digital currency).

I personally love Circle. I find Circle Pay is the cleanest simplest implementation one could get from Blockchain's disruptive technology opportunity. I fully recommend reading this post signed by Circle's CEO Jeremy Allaire to get a full understanding about what Circle brings into scene.

As Jeremy states, Circle allows users "to share payments with and send money to friends, whether across the table or across the planet, with the speed, convenience, zero cost, and fun of the Internet". Long story short, an enriched Whatsapp-like app which, besides allowing users to chat, smile, share communications with their friends and groups circles, gives them the ability to send to or receive money from each other in a way which is as simple as adding emojis to text messages.

Now, let's stop for a moment and think about what disruption Circle Pay could provoke when placed in the hands of those 2 billion people we started this post with. A tool allowing them not only to communicate but also to pay and get payed, to confirm their social inclusion. As the convinced supporter I am for the UN' reduce inequality goal, I can only wish Circle the biggest possible success and I truly look forward to getting as many vulnerable people as possible to join the Circle in the forthcoming months.

Not surprisingly, Circle is being backed by $140 million in venture capital from investors including Goldman Sachs, IDG Capital Partners and Breyer Capital. As a result of such support, the company is currently undertaking an important users acquisition strategy which includes an ambitious ambassadors program aimed at creating brand awareness and generating consumers' traction worldwide.

But Circle's strategy is not without risks. An obvious one is the high entry cost associated to its competition landscape, and I am not talking here about sending and receiving money: in a world massively dominated by social communication tools such as Facebook Messenger or WhatsApp, it is tough to get additional space for new players, even when newcomers provide key features on top. Circle Pay allows me to do everything I do with WhatsApp today plus handling all money interactions with my contacts, such as sharing birthday gift payments in our family group or paying our baby-sitter. Provided they follow me and join Circle too. The question is: will such a difference be enough as to generate an active critical mass switch from WhatsApp-like apps? Will I become an spontaneous ambassador within my own circle of friends to make them realize that, if we switched all to Circle Pay, our next soccer team meal would be much easier to organize?

Users in highly developed countries, we are becoming lazier and lazier when it comes to mobile apps. Too much information, lots of things to handle, little time. We only act on must-have's, and Circle Pay current value proposition has the risk to be perceived / filtered as a nice-to-have only. That would be extremely unfair, and I believe most of those 2 billion vulnerable people would agree with me. They would do anything to get such an app installed and gain access to a must-have a social inclusion tool. Unfortunately, our western KPIs rarely take such realities into account, we lost the ability to measure success in the absence of demonstrable numbers. Circle will require to focus on users' acquisition penetration in highly developed countries, which is where the smartphones and the network infrastructures are massively run today.

So what could Circle do to handle such risk? How could they make sure their value proposition is perceived as a must-have in the First World, where social inclusion is -wrongly- not perceived as a major concern?

The answer is not in The Circle, it is in The Square.

Whether it is about sending or it is about receiving money, most of our money exchange interactions happen with people outside of our Circle. Our money exchanges happen with restaurants, pop-up stores, boutiques, flowers, chocolates, pubs, concerts, museums, visits, excursions, pubs, repair services, healthcare services, education services, books, sports, clubs, associations. We could represent such exchanges as happening inside a Square of business of all sizes and natures.

The premise is simple: "sending and receiving money does not primarily happen inside The Circle, money flows from and to The Square, therefore it is key for me to embrace The Square".

Introducing The Square inside the equation brings Circle's added value closer to a must-have. Think about Circle Pay no longer as a tool ""to share payments with and send money to friends" but as a tool ""to share payments with and send money to anyone, whether in my in-circle or my out-square", regardless of personal relationships. With the inclusion of The Square, the final solution would exponentially increase its potential.

Fair enough, nice theory but... how to get that into work? I mean, how to connect with people in The Square when I do not know who they are nor where they are nor what they can propose to me? After all, a Circle vision is static: my contacts are my contacts, no matter where I am, no matter where I go, no matter what I do. But The Square is intrinsically dynamic, it clearly depends on where I am, where I go and what I envision to do. How to Bluetooth for The Square?

This is when a Square technology needs to come into scene: geo-intelligence. Geo-intelligence not as "a static location pin in a map", like GoogleMaps. Geo-intelligence as "a dynamic content, offer, contract, opportunity or service with the ability to generate a money exchange transaction in a map", like Kitewalk.

Kitewalk is a Web-Services enabled technology company that can help answer the previous questions and deliver a Square implementation: from restaurants to sports clubs, from city town halls to concert organizers, Kitewalk can bring potential actors inside The Square of business the ability and the opportunity to get automatically discovered by users around them which would be interested in their products and/or services. Such discovery would happen at the appropriate times when a money exchange interaction would be likely to happen between them.

The reverse is also true: Kitewalk could also allow Circle Pay app users to keep handy not only their list of (static) Circle contacts but also the list of (dynamic) Square actors at reach who would likely provide to them the products or services they are looking for matching their time, space and user preferences criteria. Anytime. Anywhere.

At Kitewalk, we believe that introducing the notion of The Square as an extension to The Circle would boost the western users reasons to download Circle Pay. A tool which would not only allow to communicate and exchange money with your friends, but to communicate and exchange money with anyone.

After all, money is not about The Circle, it is about The Square.

One living example of Kitewalk's Web Services geographical intelligence layer and its fitness to deliver a Square implementation is MyHappyHour, Kitewalk's B2C testing platform. Created back in 2013, it features a B2C app which gets populated with Facebook Open Events which are nightly extracted via Facebook's Open Graph API for specific cities in the world (those where we have MyHappyHour end users using and consuming the published data). The app features a one-click event discovery button which works in time and space by correlating users with their times, locations and preferences to deliver to every user a unique vision of the world, anytime anywhere.

MyHappyHour does not allow for money exchange between parties because that is not part of Kitewalk's value proposition which is making relevant information reach the right user at the right time and in the right place. In exchange, just as Circle Pay, it does allows users to get in contact and chat both with their friends (The static Circle) and with the events organizers (The dynamic Square), wherever and whenever they are.

Conclusion

Circle has a strong potential to make their users base grow with the addition of the The Square. As the users base will grow, it will become easier and easier to engage Square players. Reversely, the more Square players, the higher the -western- users interest to keep Circle installed in their devices (aka., user retention). If Circle Pay' users could get in contact with their opportunities around and engage into money exchanges with them, Circle acquisition and retention strategies would get highly reinforced. Kitewalk's underlying Web Services enabled geo-intelligence technology (such as the one offered through MyHappyHour) can help Circle achieve just that.Blockchain disrupts. Geo-intelligence fuels such disruption.

Comments

Post a Comment